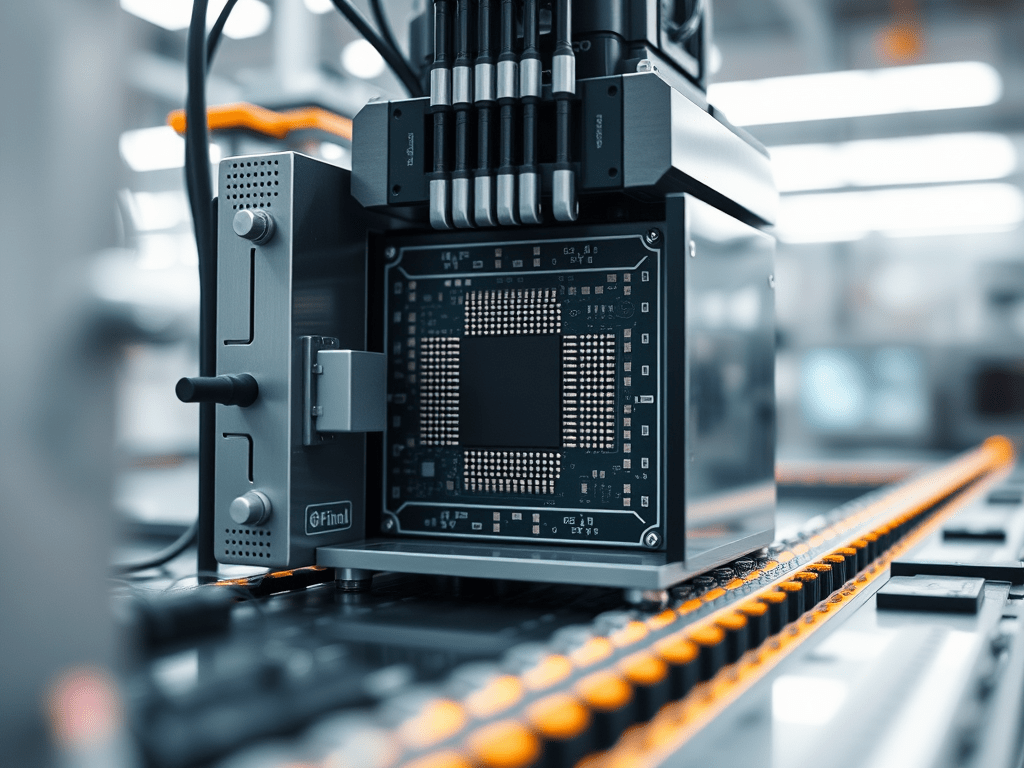

The escalating technology tensions between the United States and China, particularly in the semiconductor industry, have led to significant shifts in global supply chains and technological development. U.S. sanctions aimed at restricting China’s access to advanced chip-making technologies have inadvertently spurred China to accelerate its efforts toward technological self-reliance. This article explores how the U.S.-China chip war is prompting China to develop new industries, reinvent existing ones, and potentially free itself from future sanctions. We will delve into the industries and technologies emerging from China’s chip-making ambitions and estimate the potential economic impact of this transformative journey.

The Catalyst for Change: U.S. Sanctions on China’s Semiconductor Industry

The U.S. government has imposed several restrictions on Chinese tech companies, citing national security concerns. Key measures include adding companies like Huawei and SMIC (Semiconductor Manufacturing International Corporation) to the Entity List, effectively limiting their access to critical U.S. technologies. Moreover, the U.S. has pressured allies to restrict the export of essential equipment, such as Extreme Ultraviolet (EUV) lithography machines from Dutch company ASML, crucial for producing cutting-edge chips at 7nm and below.

These actions have created immediate challenges for China’s tech sector but have also acted as a catalyst for China to invest heavily in developing its own semiconductor ecosystem. A recent example is Huawei’s deployment of chips in its Mate 60 series that reportedly perform on par with those produced using 5nm technology, despite the significant technological hurdles posed by U.S. sanctions.

Alternative Paths to Technological Achievement

Much like there are multiple ways to cook the same dish, there are different methods to achieve similar technological outcomes. China’s recent advancements, particularly through Huawei’s collaboration with SMIC, illustrate this principle. While the chips in Huawei’s new smartphones may not be produced through the same 5nm process utilized by global leaders like TSMC and Samsung, they demonstrate comparable performance. This suggests that China is achieving results analogous to 5nm technology, albeit through alternative methods.

1. Domestic Lithography Equipment Manufacturing

- Companies like Shanghai Micro Electronics Equipment (SMEE): SMEE is making strides in developing indigenous lithography machines, including DUV and potentially EUV technologies. This move aims to reduce reliance on ASML and other foreign suppliers.

2. Semiconductor Manufacturing Equipment (SME) Producers

- Deposition and Etching Equipment: Chinese firms are investing in Chemical Vapor Deposition (CVD), Physical Vapor Deposition (PVD), and etching technologies essential for chip fabrication.

- Metrology and Inspection Tools: Development of advanced inspection systems to ensure quality and yield in chip production.

3. Material and Chemical Suppliers

- High-Purity Silicon Wafers: Companies like National Silicon Industry Group (NSIG) are focusing on producing ultra-pure wafers domestically.

- Photoresists and Specialty Gases: Domestic production of photoresists and gases used in lithography and etching processes.

4. Electronic Design Automation (EDA) Software

- EDA Tool Development: Firms such as Empyrean Technology are creating software tools for chip design, reducing dependence on U.S. companies like Cadence and Synopsys.

5. Fabless Semiconductor Companies

- AI and Mobile Chip Designers: Companies like HiSilicon (a subsidiary of Huawei) are developing advanced processors for smartphones and AI applications.

- RISC-V Architecture Adoption: Promoting open-source architectures to circumvent restrictions on ARM technologies.

6. Foundries and Fabrication Plants

- SMIC’s Expansion: SMIC is investing in new fabs and advancing its process technologies to 7nm and potentially beyond. Although SMIC is not yet producing chips at a true 5nm scale, the company’s innovations have allowed it to approximate 5nm performance using more complex methods such as multiple patterning.

7. Memory Chip Production

- Yangtze Memory Technologies Co. (YMTC): Focusing on NAND flash memory development.

- ChangXin Memory Technologies (CXMT): Working on DRAM production.

8. Advanced Packaging and Testing

- 3D Chip Stacking and Chiplet Technologies: Enhancing performance without relying solely on smaller nodes.

- Testing Services: Establishing comprehensive testing facilities to ensure international standards are met.

9. Raw Material Mining and Processing

- Rare Earth Elements: Investing in the extraction and processing of rare earth metals crucial for electronics.

10. Alternative Semiconductor Materials

– **Compound Semiconductors:** Research into materials like gallium nitride (GaN) and silicon carbide (SiC) for high-power and high-frequency applications.

11. Quantum Computing and Photonics

– **Quantum Chip Development:** Institutions like the Chinese Academy of Sciences are exploring quantum processors.

– **Photonics:** Investments in optical computing and communications.

12. Automotive Semiconductors

– **Chips for Electric Vehicles (EVs):** Catering to the growing EV market, both domestically and globally.

13. Software Ecosystems

– **Operating Systems and Middleware:** Developing software optimized for domestic hardware, such as Huawei’s HarmonyOS.

14. Talent Development and Education

– **Semiconductor Education Programs:** Universities are expanding programs to cultivate a skilled workforce.

Economic Impact: Potential Profits and Market Growth

Estimating the exact economic impact of China’s burgeoning semiconductor industry is complex due to the dynamic nature of global markets and the opacity of some Chinese firms. However, we can make informed projections based on available data.

- Investment Levels: China has announced plans to invest over $150 billion in its semiconductor industry over a decade, according to a report by the Semiconductor Industry Association.

- Market Share Goals: China’s goal is to produce 70% of the semiconductors it consumes by 2025, up from approximately 16% in 2020.

- Potential Revenues: If China meets its production goals, domestic semiconductor companies could generate revenues exceeding $200 billion annually by 2025, considering the global semiconductor market was valued at around $440 billion in 2020.

Without U.S. sanctions, China might have continued relying on imported technologies, delaying investment in domestic alternatives. The sanctions have accelerated timelines, leading to increased funding and policy support for the semiconductor sector. Huawei’s success in deploying chips that mimic 5nm performance despite technological and logistical challenges is a clear example of this accelerated innovation.

Challenges and Considerations

While the drive toward self-sufficiency offers significant opportunities, several challenges remain:

- Technological Gaps: Advanced nodes (5nm and below) require expertise and equipment that are still under development in China.

- Intellectual Property (IP) Risks: Rapid development may lead to IP disputes, particularly if companies inadvertently infringe on existing patents.

- Global Market Acceptance: Gaining trust and market share internationally will require meeting stringent quality and reliability standards.

Conclusion

The U.S.-China chip war is reshaping the global semiconductor landscape. U.S. sanctions intended to curb China’s technological rise are inadvertently fueling it by forcing China to develop its own semiconductor ecosystem. This shift could lead to the creation of numerous industries and technologies, from lithography equipment and EDA software to advanced materials and quantum computing.

Economically, China’s new chip industry has the potential to generate hundreds of billions of dollars in revenue, significantly impacting global markets. The move toward self-reliance not only mitigates the effects of current sanctions but also reduces the leverage of future sanctions.

China’s innovative approach, much like finding alternative ways to cook the same dish, illustrates its ability to achieve 5nm-equivalent results, even if the process differs from those used by industry leaders. The long-term sustainability and scalability of these methods will determine China’s future position in the global semiconductor market.

In the long run, this transformation may lead to a more diversified and resilient global semiconductor industry. For China, the pursuit of technological independence is not just a strategic necessity but also an opportunity to become a leader in next-generation technologies.

References

- Semiconductor Industry Association. (2020). Strengthening the Global Semiconductor Supply Chain in an Uncertain Era.

- McKinsey & Company. (2019). Semiconductors in China: Brave New World or Same Old Story?

- International Data Corporation (IDC). (2021). Global Semiconductor Market Forecast.

Leave a comment