investment

-

Future of Tesla: Key Drivers and Risks for Investors

Tesla’s share-price fluctuations have sparked renewed debate over its towering market capitalization—currently around $800 billion, exceeding the combined value of all other U.S. automakers. This valuation reflects investor optimism about Tesla’s transformative potential rather than purely current fundamentals. Yet, Tesla’s recent 30% stock price decline since December 2024 signals growing investor skepticism. The Valuation Mirage: Continue reading

-

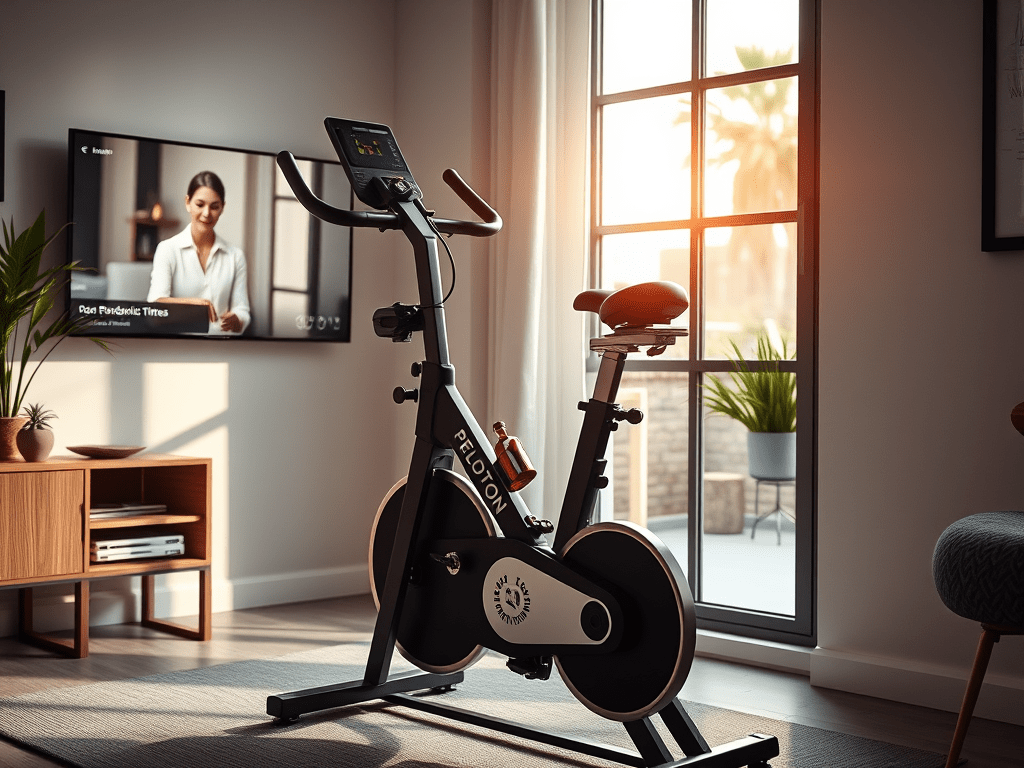

Peloton: Can It Turn Around Its $2 Billion Debt Into a Comeback Story?

Peloton Interactive (PTON) has long been a household name in the connected fitness world. Its sleek exercise bikes, interactive classes, and community-driven approach catapulted it to fame during the pandemic when at-home fitness became a necessity. But post-pandemic realities hit hard, and Peloton now finds itself navigating a challenging financial landscape, burdened with $2 billion Continue reading

-

VinFast: Vietnam’s Ambitious Electric Vehicle Pioneer

VinFast, a subsidiary of Vingroup, Vietnam’s largest conglomerate, is a newcomer to the electric vehicle (EV) market. Despite being a young company, it has set its sights on becoming a global player in the EV sector. This article explores VinFast’s journey, its current challenges, its financial health, and its future prospects, including a prediction of Continue reading

-

Poised to Benefit: Stocks on the Rise with the Self-Driving Robotaxi Trend

The self-driving robotaxi revolution is fast approaching, with significant advancements taking place globally. Wuhan, China, has already introduced a fully self-driving robotaxi service without any drivers in the driver’s seat, and Tesla is gearing up to unveil its full self-driving robotaxi in August this year. Didi Chuxing, another key player, is enhancing its capabilities to Continue reading

-

Tesla Stock Analysis (TSLA): An In-Depth Look

Introduction Tesla (TSLA), one of the most discussed and volatile stocks in the market, is currently trading at $183.01 as of June 23, 2024. The stock has seen a year-to-date decline of approximately 26.35% and a one-year decline of 28.68%. Despite these challenges, it has shown some recent positive movements, with a 5.34% increase over Continue reading