investing

-

Why Elites Don’t Benefit from Market Crashes

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, or legal advice. The opinions expressed are those of the author and are based on current market observations, which may change rapidly. Readers should consult with qualified financial professionals before making any investment decisions. All investments carry risk, including… Continue reading

-

Bond Yields and the Dollar: A Financial Paradox

In an ideal world, when investors flee from equities and pour money into U.S. Treasuries as a safe haven, the increased demand for dollars should drive the currency higher. Yet, in today’s market, we see a perplexing contradiction: the dollar is weakening while bond yields remain low—even as inflation is picking up. This unusual dynamic… Continue reading

-

The Future of Finance in a World of Automation: Rethinking “Buy Now, Pay Later”

The world is on the cusp of a massive transformation driven by automation, artificial intelligence, and the proliferation of autonomous systems. While these advancements promise unprecedented efficiency and innovation, they also raise pressing concerns about economic stability, financial systems, and the very structure of society. Among the most significant challenges is the potential displacement of… Continue reading

-

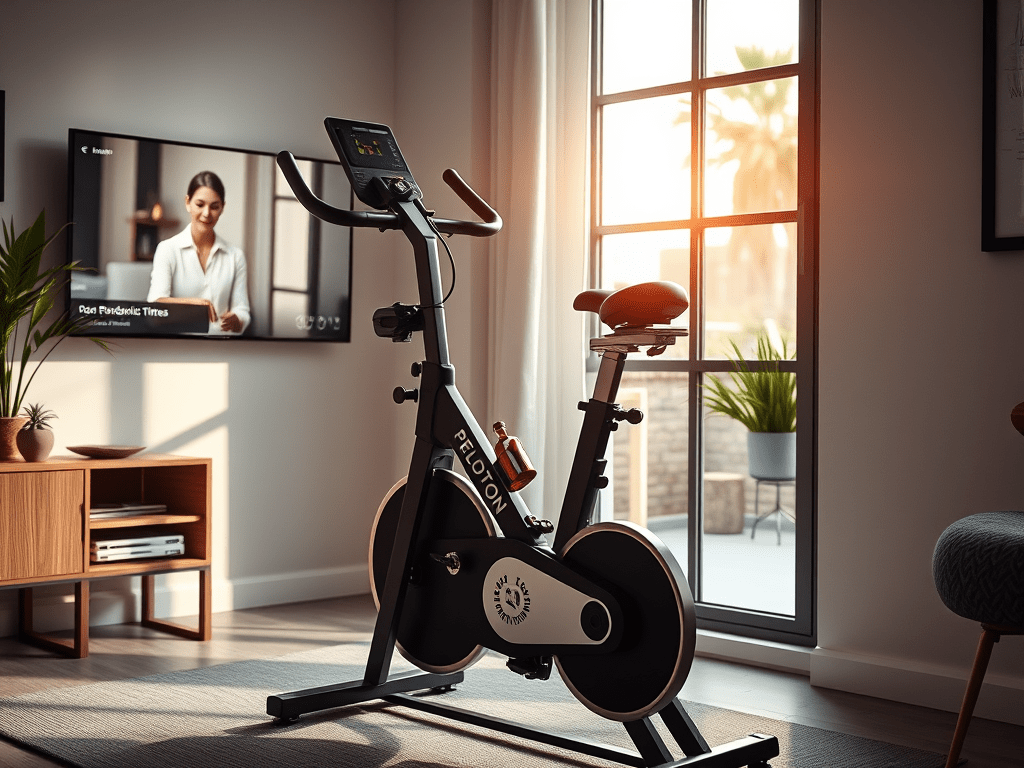

Peloton: Can It Turn Around Its $2 Billion Debt Into a Comeback Story?

Peloton Interactive (PTON) has long been a household name in the connected fitness world. Its sleek exercise bikes, interactive classes, and community-driven approach catapulted it to fame during the pandemic when at-home fitness became a necessity. But post-pandemic realities hit hard, and Peloton now finds itself navigating a challenging financial landscape, burdened with $2 billion… Continue reading

-

Investing with AI: Why Timing Your Exit is Harder than Picking the Right Company

Investing has always been about making informed decisions. Today, with tools like AI-powered platforms such as ChatGPT, investors are more equipped than ever to quickly analyze companies, understand industry nuances, and make educated guesses about potential winners. However, there’s one element of investing that remains elusive for many: knowing when to exit. AI and the… Continue reading