Magnets quietly power our daily lives—from smartphones and electric cars to wind turbines and aerospace components. Yet, despite their ubiquity, the high-performance magnets driving modern technology depend heavily on rare-earth minerals dominated by China. This dependency is not merely economic; it’s geopolitical, shaping trade tensions and national security concerns worldwide.

Enter iron-nitride magnets—specifically, Fe₁₆N₂—a potentially revolutionary alternative developed by Niron Magnetics. When paired with advanced thermal management solutions like those developed by KULR Technology, these magnets could significantly reduce global reliance on China’s rare-earth minerals.

Iron-Nitride Magnets: The New Hope?

Fe₁₆N₂ magnets offer impressive advantages, including higher magnetic saturation compared to conventional rare-earth magnets like NdFeB. While early claims of being “10 times stronger” are exaggerated, realistic laboratory results indicate about a 50–70% improvement in magnetic saturation.

Yet, iron-nitride magnets face challenges. Chief among them is their thermal stability: Fe₁₆N₂ becomes unstable above temperatures around 200°C, limiting their immediate use in critical applications such as electric vehicle (EV) motors, aerospace, and industrial turbines.

Thermal Shielding: Bridging the Heat Gap

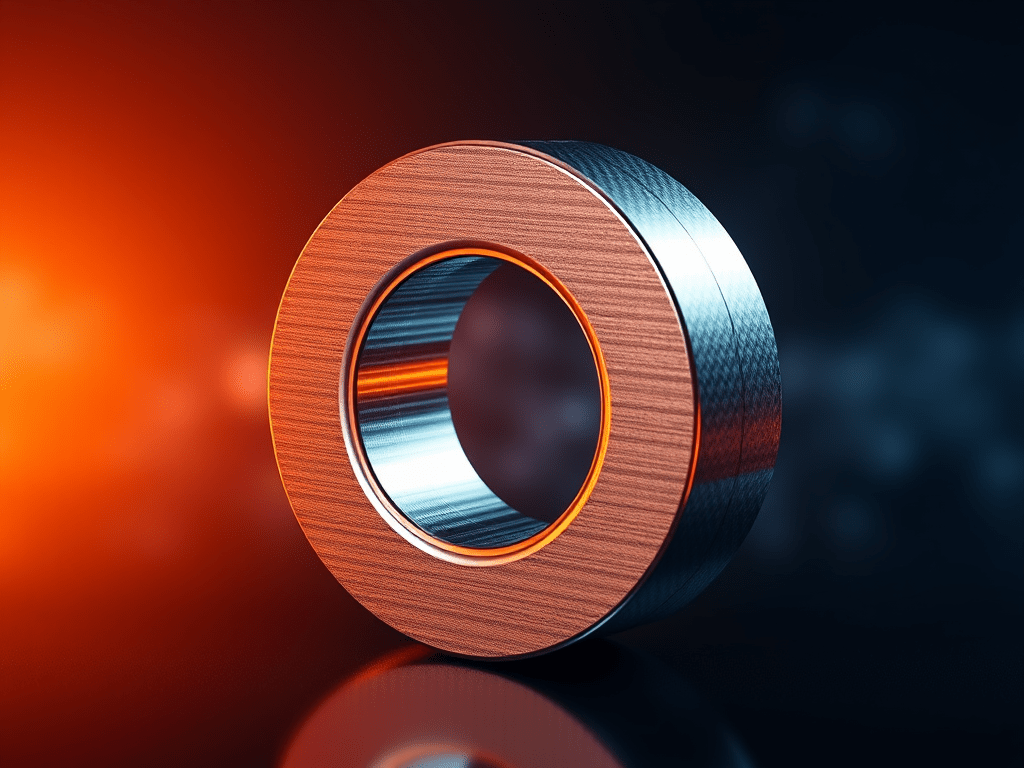

Addressing the thermal limitation is essential. This is precisely where thermal management specialists like KULR Technologies could step in. Known for carbon-fiber-based heat spreaders and advanced phase-change materials developed initially for NASA and the Department of Defense, KULR could enable Fe₁₆N₂ magnets to function reliably under higher temperature loads.

By encapsulating iron-nitride magnets within specialized thermal armor, manufacturers could extend their operational temperatures, making them viable for more demanding environments such as EV motors, renewable energy systems, and aerospace components.

Ending China’s Rare-Earth Dominance

Currently, China controls about 69% of the global rare-earth mining and nearly 90% of refining operations. This market control provides China with significant geopolitical leverage. Shifting to iron-nitride magnets—made from abundantly available iron and nitrogen—could substantially weaken this leverage.

The United States is already actively funding alternative magnet technologies through grants like the Department of Energy’s $17.5 million SCALEUP program. Niron Magnetics, backed by this funding and private industry partnerships, is gradually moving toward commercial-scale production.

Geopolitical & Economic Implications

Reducing dependency on rare earths does more than just lower material costs—it reshapes the geopolitical landscape. Countries like the United States, Europe, and Japan would benefit significantly by reducing their strategic vulnerabilities. Defense systems, renewable energy installations, and electric vehicles would become less susceptible to supply disruptions or price manipulation.

In addition, shifting away from rare-earth magnets could lower international tensions. Without the resource-driven pressures currently influencing U.S.-China relations, there’s a possibility for a more cooperative economic relationship.

Projections for Market Adoption

- 2025–2027: Early deployments of Fe₁₆N₂ magnets and thermal shielding in consumer electronics, light industrial motors, and initial EV prototypes.

- 2027–2030: Significant adoption in mainstream EVs and industrial equipment as thermal management solutions mature.

- 2030–2035: Broad-scale commercial production of iron-nitride magnets, significantly reducing rare-earth magnet usage and reshaping global supply chains.

Forward-Looking Summary

The combination of iron-nitride magnets and advanced thermal management could usher in a new era of cleaner, more sustainable, and geopolitically stable electrification. It offers a practical pathway for reducing strategic vulnerabilities and promoting international stability.

Disclaimer

This is AI generated content. The article is for informational purposes only. It does not constitute investment advice. Forward-looking statements regarding technology developments, market adoption, and geopolitical impacts are speculative and subject to change due to technological, economic, regulatory, and geopolitical uncertainties. The author of this blog post may own shares in KULR Technology Group, which may present a potential bias in their perspective.

Leave a comment