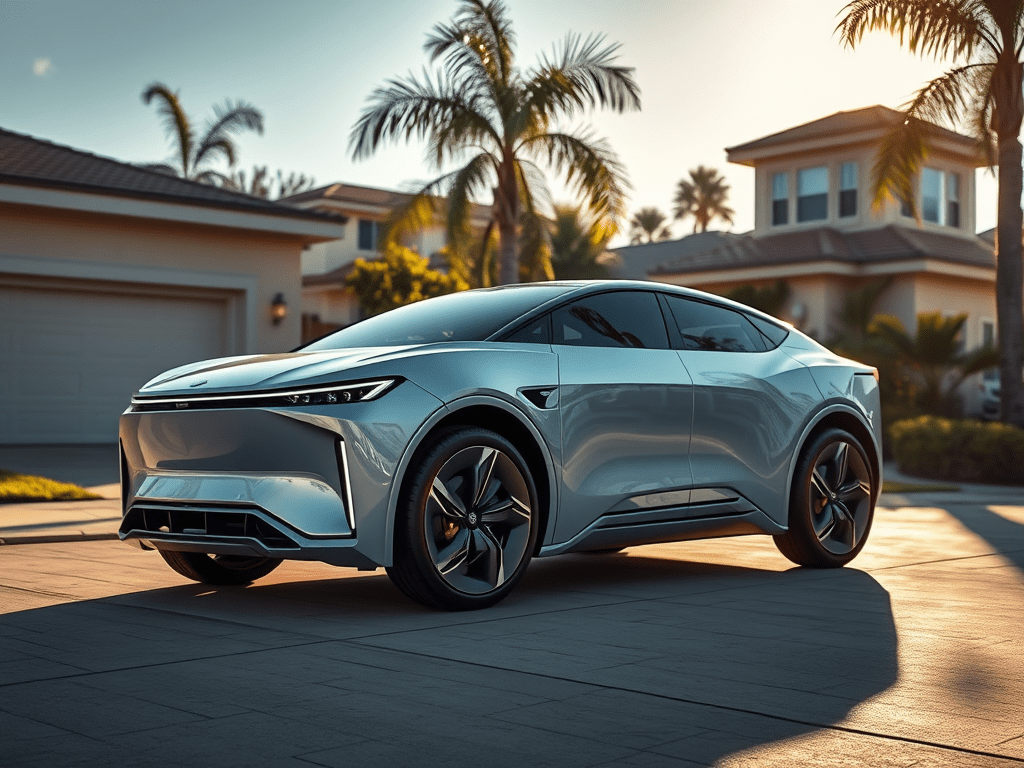

Imagine This: You wake up one morning in Los Angeles, and there’s a sleek, futuristic car silently gliding past your driveway. It’s not a Tesla. It’s not a Ford Mustang Mach-E. It’s a Zeekr 007, or a BYD Seal, or even a NIO ET5 Touring. You’ve never seen it before in person. It looks like it teleported from the year 2035. Price tag? Even after tariffs, it’s $29,000. Range? 500 miles. Charging time? 5 minutes.

And it’s made in China.

Welcome to the shock and awe strategy. A theoretical—but entirely feasible—scenario in which Chinese EV makers blitz the U.S. auto market during President Trump’s 90-day pause of Biden’s 100% EV tariff, temporarily reducing it to 30%.

Why Would They Do It? One Word: Strategy.

This isn’t just about shipping cars. It’s about breaking the psychological barrier. American consumers have never been exposed to the real Chinese EV experience. That experience—already dazzling drivers in Europe and Southeast Asia—is about to be the biggest “what the hell is this?” moment in U.S. automotive history.

If Chinese automakers flood the U.S. with even 10,000–20,000 units during the 90-day window, they don’t need to dominate the market. They only need to plant the seed.

The Consumer Shockwave: Mindshare is the Real Target

U.S. buyers get a taste of these EVs:

- Elegant interiors rivaling luxury brands

- Semi-autonomous highway driving

- Huge infotainment screens and AI voice assistants

- Battery ranges pushing past 400–500 miles

Suddenly, the average American consumer realizes: “Wait… this is possible? For $25,000–30,000? Even with tariffs?”

Now imagine what they’ll say if tariffs go back to 100%:

“Why are Canadians getting better cars for cheaper? Why can’t we?”

The Canadian Loophole: A Strategic Gateway

As Canada considers reducing or removing tariffs on Chinese EVs, it becomes the perfect gateway:

- Chinese EVs pour into Canadian markets

- Americans see them firsthand on TikTok, YouTube, and from relatives across the border

- Dealers and importers begin quietly lobbying U.S. policymakers for access

Even if the U.S. slams the door shut post-90 days, the psychological impact lingers. Demand doesn’t die. It goes underground and resurfaces politically.

Can This Be Done Logistically in 90 Days?

Surprisingly, yes—if done right:

- Pre-built vehicles in inventory redirected to U.S. ports

- Partnerships with independent dealerships or direct-to-consumer trial pop-ups

- Fleet deals with Uber, Lyft, or rental firms

- Massive PR and influencer campaigns showcasing test drives and reviews

No need for long-term infrastructure. This is a strategic mindshare grab, not a permanent distribution setup.

Who Suffers Most? U.S. EV Startups and Mid-Tier Players

Phoenix Motor Inc. (PEVM), Lordstown (RIP), Fisker (struggling), and even Canoo — these small players can’t match Chinese EV pricing, tech, or scale.

Their business models are already fragile. A sudden burst of Chinese tech at competitive prices could be the nail in the coffin for anyone without a real moat.

Final Thoughts: The Genie Doesn’t Go Back in the Bottle

The moment Americans experience Chinese EVs—even for a short window—everything changes. It’s no longer theory. It’s real. And once the market knows what’s possible, consumer expectations permanently shift.

Whether the U.S. reimposes 100% tariffs or not, the damage to the status quo will already be done.

That’s the power of a 90-day blitz.

Disclaimer: This is AI generated content. This is a speculative scenario based on current trade policy, tariff adjustments, and the known capabilities of Chinese EV makers. No predictions are guaranteed, and market conditions can change rapidly. This post is for educational and thought experiment purposes only.

Leave a comment