In typical economic downturns, industrial metals like copper usually face declining demand and falling prices. But today’s global economic landscape—reshaped by intense tariff wars, geopolitical rivalry, and splintering supply chains—is anything but typical. Copper, the backbone of modern technology and infrastructure, could not only survive but potentially thrive in this complex environment.

1. The Shift from Global Efficiency to Strategic Self-Reliance

The era of “just-in-time” global supply chains is fading. Tariff wars and technological decoupling, particularly between the U.S. and China, have reshaped global trade. Countries and major corporations are shifting towards “just-in-case” strategies, building regional supply chains and stockpiling essential resources, with copper topping the list.

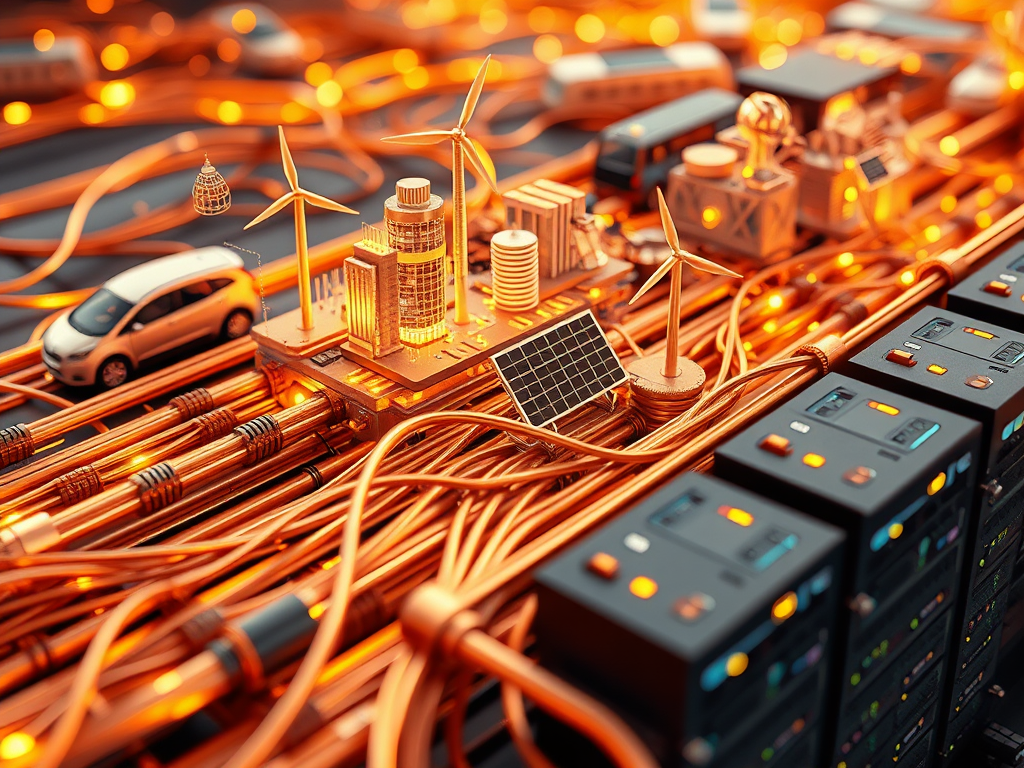

2. Copper’s Indispensable Role in Strategic Technologies

Copper is not merely a cyclical commodity—it’s now essential infrastructure. Electric vehicles (EVs) use up to four times more copper than traditional vehicles. Renewable energy projects, such as solar and wind, require significant copper wiring and grid integration components. Data centers powering the AI revolution, alongside 5G infrastructure, also heavily depend on copper for efficient power delivery and connectivity. Additionally, national defense modernization and electric-grid upgrades further intensify strategic copper demand.

3. Fragmentation Means Higher Demand, Even During Economic Slowdowns

While consumer-driven demand might soften during recessions, government-led strategic projects rarely pause. Infrastructure, military upgrades, energy transitions, and technology investments continue regardless of broader economic conditions. Fragmented global supply chains mean each geopolitical bloc—primarily led by the U.S. and China—must independently secure substantial copper supplies, thereby maintaining robust demand pressure even if global economic growth slows.

4. Persistent Supply Constraints Amplify the Bullish Outlook

On the supply side, copper production faces significant bottlenecks. Chile and Peru, which produce roughly 40% of the world’s copper, grapple with aging mines, declining ore quality, environmental regulations, and political instability. New copper mines require more than a decade from discovery to production, and geopolitical risks—like those in the Democratic Republic of Congo—add further uncertainty. As demand rises or even stays steady, supply constraints could push prices significantly higher.

5. Strategic Implications for Investors and Policymakers

Copper has evolved into a strategic asset, integral to national security and technological competitiveness. For investors, copper offers a potential hedge against economic uncertainty, benefiting from sustained strategic investment even amid recessionary pressures. Policymakers must prioritize securing reliable copper supplies to sustain national competitiveness in technology, defense, and infrastructure.

Conclusion: Copper as a Strategic Imperative

As global supply chains fragment and economic uncertainty grows, strategic resources like copper become more critical—not less. Its importance extends beyond traditional industrial cycles, positioning copper uniquely to weather economic storms, benefiting investors who recognize its strategic value early.

Final Thought:

In a fragmented world, essential resources like copper aren’t just valuable—they’re indispensable. Recognizing this shift early could prove pivotal for both investors and nations alike.

Disclaimer: This is AI generated content. The owner of this blog may hold shares in stocks mentioned in this post. This article is for informational purposes only and does not constitute financial advice. Always conduct your own due diligence before making investment decisions.

Leave a comment