1. Labor Costs Vanish When Machines Take Over

Traditionally, rising labor costs have been a major driver of inflation. Wages go up → businesses pass costs on to consumers → prices climb across the board. But in a fully automated economy:

- Robots and AI handle production, logistics, and even many services.

- Labor costs—one of the biggest inputs for any business—plummet or disappear.

- With near-zero labor expenses, businesses aren’t forced to raise prices to cover payroll.

That alone chips away at one of the fundamental pillars of inflation.

2. Production Scales Without Bottlenecks

Inflation often emerges when demand outstrips supply—too much money chasing too few goods. However, fully automated systems can ramp up production as soon as demand rises:

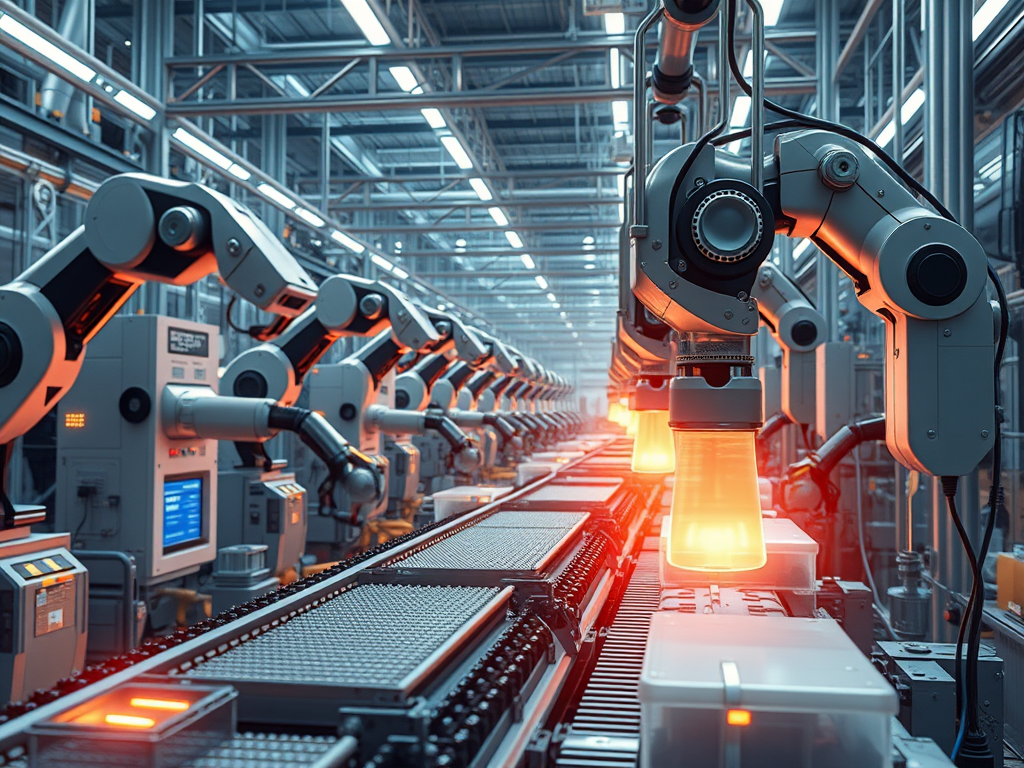

- AI-driven factories swiftly switch production lines, optimize output, and run 24/7.

- Supply becomes far more elastic, vastly reducing shortages.

When supply can match or exceed demand at high speed, the usual “pressure cooker” that drives prices up is released.

3. AI Efficiency Lowers Costs for Everything

Automation doesn’t just create more supply; it also slashes inefficiencies:

- Real-time data and sophisticated algorithms trim waste in energy, materials, and time.

- Predictive maintenance keeps production lines running smoothly, minimizing downtime.

All these optimizations add up, pushing costs down for the entire economy. Lower costs naturally fight persistent inflation.

4. Post-Scarcity Fundamentals (For Most Consumer Goods)

In a truly advanced automated economy, many goods approach “post-scarcity” status:

- Everyday items like clothing, basic electronics, or simple foods could be produced at near-zero marginal cost.

- The idea of “price” for these goods becomes more about distribution than production.

When common goods are nearly free to produce at scale, it’s hard for typical inflation to sustain itself in those categories.

5. The Remaining Sources of Inflation Become Policy Choices

Even if day-to-day items are cheap or nearly free, some products and services will stay scarce:

- Finite resources (e.g., rare-earth minerals, premium land, luxury goods).

- Monopoly-induced scarcity (a few corporations or governments controlling access).

- Policy-driven inflation, such as massive government money injections or exclusive regulations.

In other words, inflation may no longer be a structural inevitability—it becomes deliberately imposed or caused by rare bottlenecks rather than baked into the economic system.

6. Energy Is the New Currency

While labor vanishes as a cost, energy could become the key input:

- Automation and AI rely on electricity (or other forms of power) to function.

- If energy is abundant (fusion, widespread solar, etc.), production becomes nearly frictionless.

- When energy is scarce, that might be the main source of cost and inflationary pressure.

So, if humanity achieves energy abundance along with automation, widespread inflation could further dwindle.

7. Inflation Shifts From “Natural Force” to “Policy Lever”

In a fully automated economy, governments or mega-corporations might use artificial constraints (like tariffs, licensing fees, or digital paywalls) to influence price levels. This means:

- Inflation becomes a choice—they can cause it or prevent it by managing access to resources and distribution.

- It’s no longer the unstoppable wave we see in more traditional, labor-dependent economies.

We move from an era of “inflation-fighting” to “inflation-tuning.”

Conclusion: The Myth of “Persistent Inflation”

Right now, we treat inflation like the weather—an ever-present risk that governments try to manage with interest rates and fiscal policy. But in a future where machines dominate production, supply is hyper-elastic, and energy is abundant, inflation as we know it loses its natural footholds.

- Costs drop across the board.

- Supply keeps pace with demand in real time.

- Bottlenecks are technical or political, not truly economic in the old sense.

Persistent inflation, in that scenario, becomes more myth than inevitability. It shifts from an economic constant to a curated effect—only arising when policy, monopoly, or strategic resource scarcity deliberately impose it. For everyone else, the price of everyday life could trend toward zero, transforming not just inflation, but the very nature of our economy and society.

Like this post? Share your thoughts on whether a zero-inflation future is desirable—or how it might change our social and political landscape. If you see potential drawbacks, let us know: would a “free goods” system be utopian or introduce its own set of problems? Let’s keep the conversation going!

Leave a comment